Bad tenant screening Australia landlords rely on starts long before

a lease is signed. Careful tenant screening helps property investors identify early

warning signs that may indicate future rent arrears, property damage, or disputes.

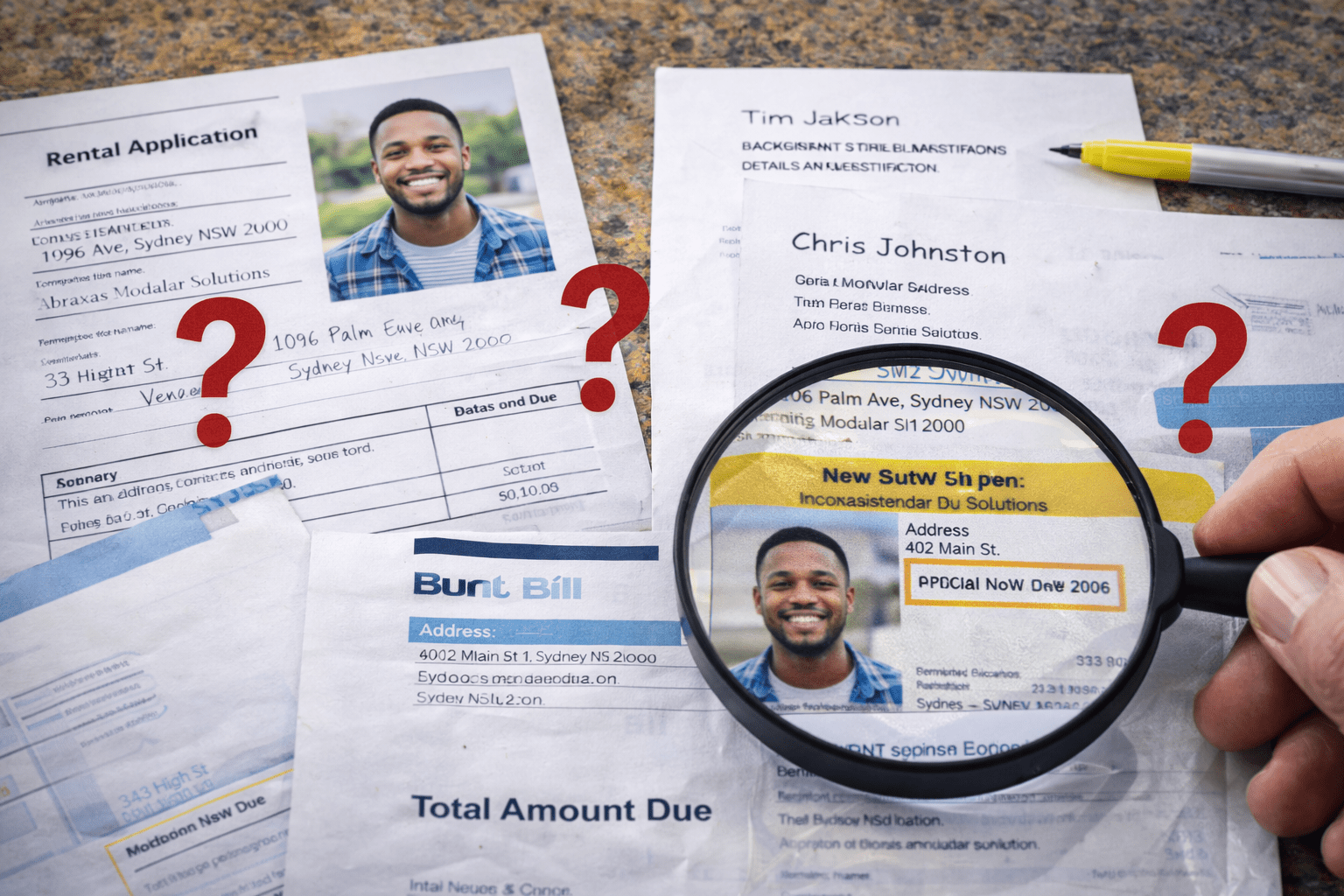

One of the most common tenant screening red flags is an application with missing or

unclear information. Strong applicants are usually open and thorough when providing

details.

When screening tenants, always compare addresses against identification, utility

accounts, and references. Inconsistencies may indicate instability or dishonesty.

Overdue electricity, gas, or internet bills can suggest financial pressure. While

not decisive on their own, they should be considered during the screening process.

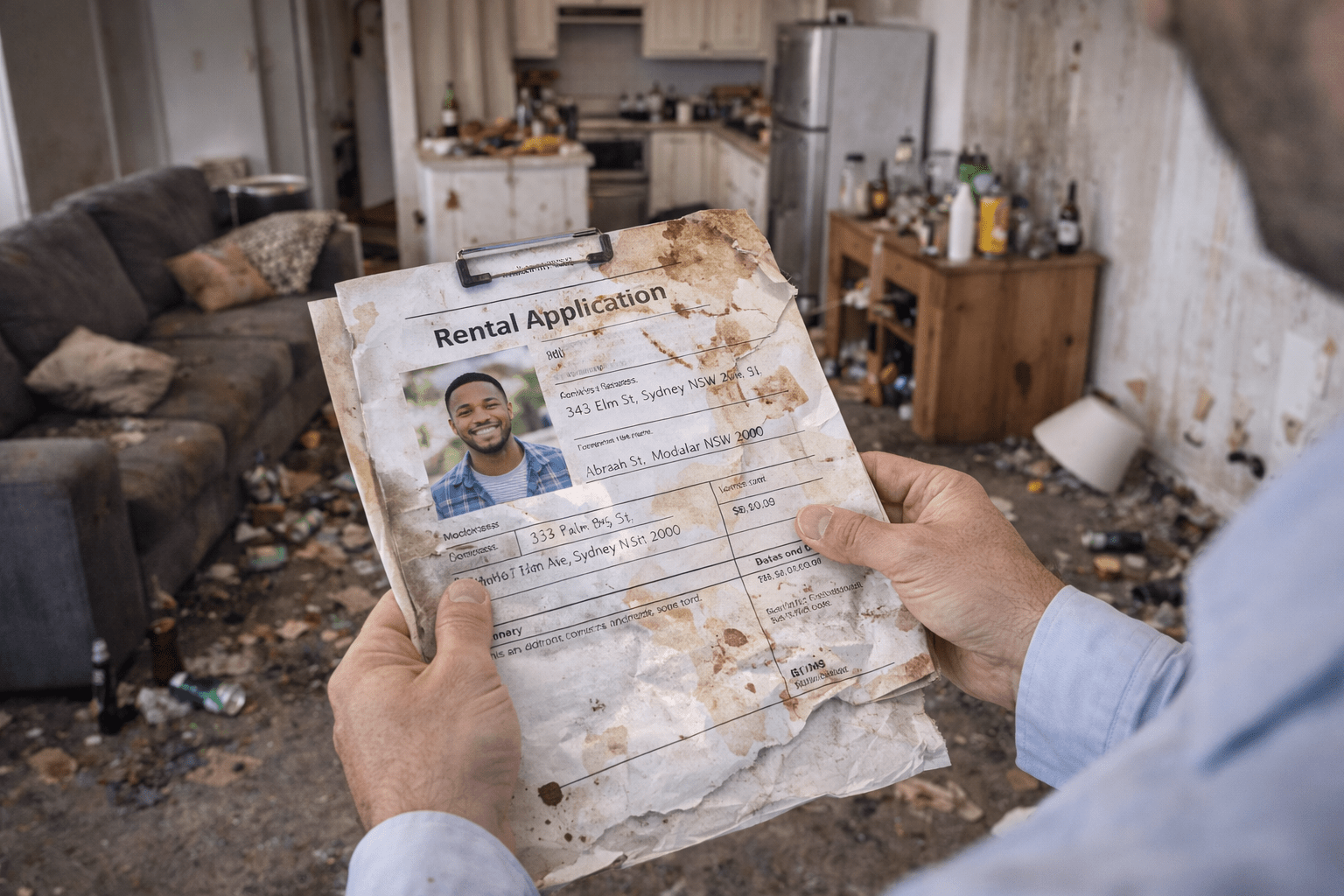

Paper applications that are stained, damaged, or poorly maintained may reflect how

an applicant treats their living environment.

Inconsistent explanations about current housing or reasons for moving may indicate

undisclosed tenancy issues and should be clarified.

A drive-by of an applicant’s current residence can provide useful insight into how

they maintain a property, particularly for Australian landlords managing risk.

Professional tenant screening often includes checking tenancy default databases for

previous breaches such as unpaid rent or property damage.

Applicants without a clear rental history may still be suitable, but additional

screening questions are essential before approval.

While no single indicator confirms a bad tenant, combining multiple screening signals

provides a clearer risk profile and supports better decision-making.

Legal note (Australia): Tenant screening must comply with residential

tenancy laws and anti-discrimination legislation. Decisions should always be based on

lawful, objective criteria. This article provides general information only and does not

constitute legal advice.

For expert assistance with compliant tenant screening, speak with your

property manager or explore our

landlord resources.